See? 33+ Facts On A Long-Term Asset Is Recorded At The: They Forgot to Let You in!

A Long-Term Asset Is Recorded At The: | These assets will give ideas about the liquidity of the company and where the company expects to liquidate the. Cost of the asset plus all costs necessary to the asset ready for use. All assets are resources controlled by the enterprise as a result of past events and from which future economic benefits are. This is true for all assets except for a few different types of. Purchased intangibles are recorded at the cost incurred to purchase an intangible asset from another entity, which includes the acquisition costs as well as expenditures.

Fixed assets ○ current assets ○ cash ○ debtors ○ anticipate the loss ○ write off ○ bad debt ○ make provisions. Skousen & ventus publishing aps. Cost of the asset plus all costs necessary to the asset ready for use. The company records an item of property, plant and equipment initially at its cost in the accounting record. It's the term used to describe advance payments for insurance coverage.

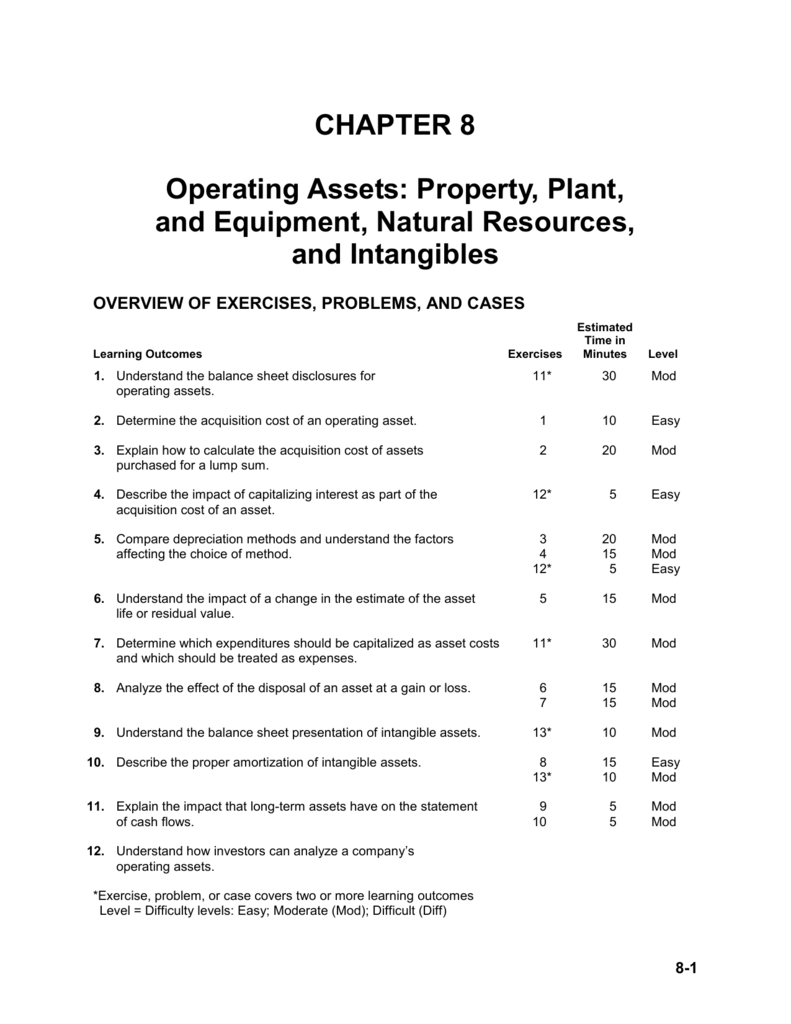

Liquid assets (or available assets) are anything that can quickly be turned into cash. The gain or loss account name varies between textbooks, so make sure you use the name indicated by your professor/textbook. The company records an item of property, plant and equipment initially at its cost in the accounting record. This is true for all assets except for a few different types of. Purchased intangibles are recorded at the cost incurred to purchase an intangible asset from another entity, which includes the acquisition costs as well as expenditures. Distinguish between tangible and intangible assets. Tangible assets are generally recorded at their historical cost less — the amount of their cost that has already been deducted from profits. Long term assets, on the other hand, are resources that are expected to last more than one accounting period. It initially reports fixed and intangible assets at their acquisition cost. A change in the estimated salvage value of a plant asset requires a restatement of prior years' depreciation. Selling selected assets is one option under consideration. On the statement of cash. All assets are resources controlled by the enterprise as a result of past events and from which future economic benefits are.

A change in the estimated salvage value of a plant asset requires a restatement of prior years' depreciation. Fixed assets ○ current assets ○ cash ○ debtors ○ anticipate the loss ○ write off ○ bad debt ○ make provisions. If the amount of the proceeds is greater than the book value or depreciation must be recorded up to the date of the disposal in order to have the asset's book value at the time of the sale. The company records an item of property, plant and equipment initially at its cost in the accounting record. On the statement of cash.

Distinguish between tangible and intangible assets. The open grill incurred the following costs in acquiring a new piece of land: 10 machinery and equipment purchase price taxes transportation charges machinery and equipment is recorded at its purchase price less any available. These assets will give ideas about the liquidity of the company and where the company expects to liquidate the. Value of property, equipment, and other capital assets minus the depreciation. 2.6 types of assets 1. Net current assets (or working capital) are the excess of current assets (such as cash, inventories, debtors) over current liabilities (creditors, overdrafts, etc.). According to the historical cost principle, assets are recorded on the books at the price the company paid for them. It initially reports fixed and intangible assets at their acquisition cost. The gain or loss account name varies between textbooks, so make sure you use the name indicated by your professor/textbook. Remember that the cost principle states that assets must be recorded at cost. On the statement of cash. All assets are resources controlled by the enterprise as a result of past events and from which future economic benefits are.

This is true for all assets except for a few different types of. It initially reports fixed and intangible assets at their acquisition cost. The company records an item of property, plant and equipment initially at its cost in the accounting record. All material in this publication is the manager was given responsibility for streamlining operations and restoring profitability. On the statement of cash.

These assets will give ideas about the liquidity of the company and where the company expects to liquidate the. Mr a will be liable to pay a tax of ₹ 1,18,007 on his long term capital gains of ₹ 5,90,034 on this property 3.under section 54 ec, sell a long term capital asset and get capital gains tax exemption by investing in 54ec capital gain bonds. On the statement of cash. 10 machinery and equipment purchase price taxes transportation charges machinery and equipment is recorded at its purchase price less any available. This group usually consists of three types of investments : Assets are typically assigned to accounts based on the type of asset. Furthermore, although they may ramble in order to elaborate a point and give additional information and details where appropriate, they will not digress. Value of property, equipment, and other capital assets minus the depreciation. Investments in fixed assets not used in operations (e.g. Cost of the land$80,000 commissions 4,800 liability insurance for the first year 1,200 cost of removing existing. When using the allowance method bad debt expense is recorded when an individual customer defaults. They will avoid technical terms, abbreviations or jargon. It includes all costs that necessary to bring the asset to the working condition.

A Long-Term Asset Is Recorded At The:: A long lived asset is any asset that a business expects to retain for at least one year.